The rise of artificial intelligence is reshaping global infrastructure, and nowhere is this more evident than in the energy sector. As hyperscale data centers proliferate to support AI workloads, the demand for reliable, scalable, and clean energy is exploding. This piece explores the types of energy needed, recent strategic deals, the stocks and ETFs poised […]

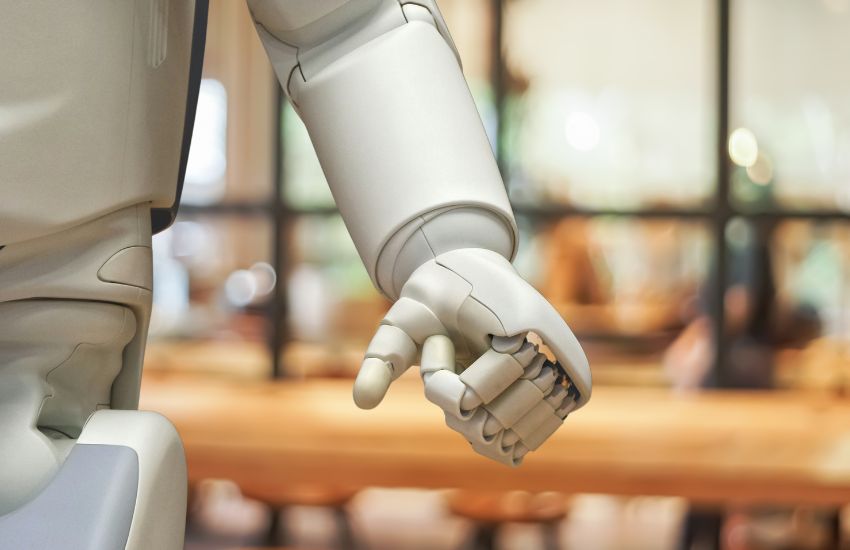

The rise of humanoid robots

Humanoid robots are shifting from sci-fi fantasy to reality, thanks to modular innovations in AI chips, sensors, and actuators. Instead of reinventing components, manufacturers can now focus on seamless integration, accelerating accessibility and commercial viability. With costs ranging from $15,000 to $60,000, industries like healthcare, logistics, and retail are set to embrace humanoid robots by 2030, marking a new era in automation.

The 7 key components of a resilient portfolio

A resilient portfolio weathers market uncertainty while achieving long-term goals. Diversify wisely, maintain liquidity, limit debt, and adapt your strategy over time. Smart asset allocation and disciplined investing ensure financial stability through market shifts.

How to grow your wealth over time: the power of compounding

Compounding allows your wealth to grow exponentially over time. By reinvesting earnings, your investment base expands, accelerating growth. Start early, stay invested, and let time work in your favor. Patience and smart reinvestment can double your wealth in just 15 years.

Managing your portfolio: how to choose a bank?

Choosing the right financial institution is key to managing your wealth securely. Consider factors such as the custodian’s financial stability, tax statement availability, and the investment services you need. Whether self-managing, seeking advice, or delegating, finding the right bank or broker ensures peace of mind and effective portfolio management.

How to choose an ETF: 6 important factors to consider

ETFs offer broad diversification and low management fees, making them an attractive investment option. When choosing an ETF, consider key factors such as the underlying index, replication method, ongoing charges, performance, assets under management, and issuer reputation. A well-selected ETF should closely track its index and offer cost-efficiency.